Home > Employee Benefits

Employee Benefits

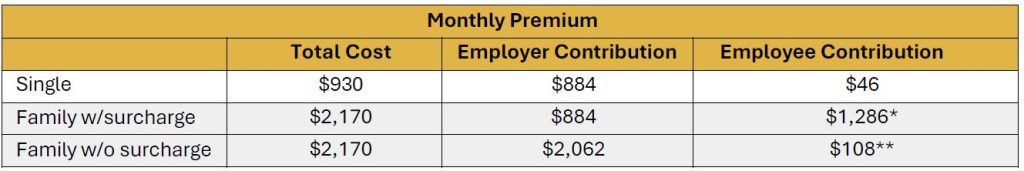

Medical and Prescription Drug Plan Combined Premium Rates

7/1/2025 – 6/30/2026

*The monthly family premium for employees whose spouse and/or dependents have access to other group health coverage is $1,286, which includes a $1,240 surcharge and a $46 single premium.

**The monthly surcharge can be waived when the employee provides evidence that their spouse and/or dependents do not have access to other group health coverage. Evidence is provided through an affidavit process.

The annual expense for a parish/school location is $10,608 for a single and $24,744 for a family plan for those employees who do not pay the surcharge.

The AOC Welfare Benefit Plan is a non-ERISA ‘church plan’ with Grandfathered status under the Affordable Care Act (ACA). Employees are offered single coverage with a low monthly premium. Family coverage is available to include the spouse and/or dependents with a monthly surcharge if the spouse and/or dependents have other group health plan coverage available to them. This monthly surcharge can be waived when the employee provides evidence that their spouse and/or dependents do not have access to other group health coverage. Employees are required to inform administration of any change in the availability of other group health coverage during the plan year as it may be considered a qualifying life event, potentially altering the waiver status of the surcharge for the remainder of the year.

Any false or misrepresented eligibility information will cause both your coverage and your dependents’ coverage to be retroactively terminated (to the extent permitted by law). Non-compliance is considered fraud and can result in recouping surcharge, claims paid and dismissal of those complicit in the fraud.

Affidavit/Coverage Verification Letters

Affidavit letters need to be downloaded by an employee requesting family coverage under the Archdiocese of Cincinnati Health Care Plan. The portion of the letter above the red line needs to be completed by that employee and then forwarded to the Human Resources Director of the employee’s spouse (and/or other parent of any dependent children) for completion. The employee requesting the family coverage under the Archdiocese of Cincinnati Health Care Plan returns via email to: [email protected]. The Benefits Office will then process the completed letter for determination of surcharge waiver.

frequently asked questions

Who is eligible for benefits?

Active employees who are deemed eligible for benefits under the Archdiocese of Cincinnati Healthcare Plan, according to the plan provisions, must satisfy a waiting period prior to benefits becoming effective. Benefits will become effective the first day of the month following date of hire. This section of the Employee Benefits website is intended to be a summary of the eligibility provisions outlined in the Summary Document.

Eligibility for the Medical, Dental, Vision and FSA Plans

- Full-time employees who work 30+ hours per week or teach 15+ classroom hours per week.

- Variable-hour employees who have worked an average of 30+ hours per week or have taught an average of 15+ classroom hours per week during the prior 12-month measurement period.

- Teachers who are employed by Athenaeum of Ohio and teach 14+ semester hours per year (or have taught an average of 14+ semester hours per year during the prior 12-month measurement period for variable hour teachers).

Eligibility for Life, AD&D and Long-Term Disability Insurance

- All employees who are scheduled to work 20+ hours per week or teach 12+ classroom hours per week.

- Teachers who are employed by Athenaeum of Ohio and teach 9+ semester hours per year.

Applies to All Benefits

- School employees are eligible if they meet the above-stated hourly requirements for the period of time school is in session.

- Employment at more than one location will be combined for eligibility purposes.

Eligible Spouses or Children

- The plan allows coverage for your legal opposite-sex spouse and/or your child(ren) (biological, adopted, step or foster) from birth to the end of the month that your child attains age 26.

- Eligible spouses and dependent children may select the Archdiocese of Cincinnati Healthcare Plan even if the spouse has access to group medical insurance coverage as an employee or the child has access to group medical insurance coverage available through the employer of another parent. In this case, however, the Archdiocese will require the employee to pay 100% of the cost of the spouse or dependent coverage.

How do I select my benefits?

The Archdiocese of Cincinnati utilizes the online enrollment system, MyEnroll, for employee's convenience to make selections for medical, prescription drug, flexible spending accounts, dental, life and long term disability insurance selections. MyEnroll is available online 24/7 for employees to review their Benefit record as well as monitor and submit FSA claims.

Enrollment choices and selections are available upon new hire and also during the annual open enrollment period. Consider your options carefully and follow the steps below to make smart enrollment choices.

Step 1: Confirm your eligibility and understand your options

- Read through the 2024-2025 Enrollment Guide

or

- Review the pages of this website to learn more about your benefits

Step 2: Plan for your needs

- Review your current benefits and coverage levels: what make the most sense for you and your family?

- Decide which dependents you will cover; eligible employees have two coverage levels to choose from:

- Employee Only

- Family

Step 3: Request your MyEnroll user ID and password

- If you don't already have a user ID and password, follow these steps to obtain one.

- The MyEnroll temporary issued password expires in 48 hours; if you do not log in within that time-frame, you will have to request another password.

Step 4: Gather proof documents for new dependents

- Scan in necessary proof documents and save the documents to your desktop as one PDF per dependent

- You will need to submit these during the online enrollment process by attaching the scanned documents to your MyEnroll file when prompted

- You can also fax your proof documents to 1.887.265.2144

Step5: Enroll

- Log onto MyEnroll using your user ID and password

- Click "Go" located within the pink box at the top of your MyEnroll page

- When prompted, upload the necessary proof documents for new dependents. The proof documents can also be faxed to 1.887.265.2144.

Step 6: Conclude enrollment

- Review the summary and signature page. If you are happy with your selections, click Accept and Finalize; this will conclude your enrolment.

What is the Dependent Surcharge?

The Archdiocese of Cincinnati (AOC) Welfare Benefit Plan is a non-ERISA group health plan that maintains grandfather status under the Affordable Care Act (ACA). Employees are offered single coverage with a low employee premium charge. Family coverage is available to include the spouse and children, but with a monthly surcharge if the dependents have other group health plan coverage available to them. This monthly surcharge can be waived if it is determined the spouse and/or other parent is not eligible for other group health plan coverage.

The 2025-2026 plan year medical/prescription premium for single coverage is $930.00 per month. For eligible employees, the parish/school location pays $884.00 and the employee’s portion of the premium is $46.00 per month.

The 2025-2026 plan year medical/prescription premium for family coverage is $2,170.00 per month. For eligible employees, the parish/school location pays $2,062.00. The additional expense to a location for an employee’s family premium over the single premium is $1,240.00 per month. The employee may be subject to a monthly surcharge of $1,286.00 for this additional cost. The surcharge can be waived when the employee provides evidence that their dependents have no access to other group healthcare coverage. Once the necessary steps to waive the surcharge are accomplished then the employee premium for family coverage is $108.00 per month.

Any change in the status of other available Group Health coverage during a plan year may be considered a Life Event and changes the waiver status for dependent surcharge during the plan year.

Any false or misrepresented eligibility information will cause both your coverage and your dependents’ coverage to be retroactively terminated (to the extent permitted by law). Non-compliance is considered fraud and can result in recouping surcharge, claims paid and dismissal of those complicit in the fraud.

Which Proof Documents are needed to add a Dependent?

Legal Opposite-Sex Marriage

Marriage certificate (must be from local government)

Federal income tax return (first page - dollars may be redacted)

Biological Child

One of the following:

Birth certificate of biological child (listing Employee as parent)

Documentation on hospital letterhead indicating the birth date of child(ren) under 6 months old

Federal income tax return

Adopted Child

One of the following:

Official court/agency papers (initial stage)

Official Court Adoption Agreement (mid-stage)

Birth certificate (final stage)

Federal income tax return

Foster Child

Official court or agency placement papers

Stepchild

All of the following:

Child’s birth certificate showing the child’s parent is the employee’s spouse

Marriage certificate showing legal marriage between the employee and the child’s parent

Other Child

Court papers demonstrating legal guardianship, including the person named as legal guardian

Court-Ordered Medical Coverage

One of the following:

Qualified Medical Child Support Order (QMCSO

National Medical Support Notice (NMSN)

What are Qualifying Mid-Year Life Events?

Employee contributions and FSA contributions are made on a pretax basis. Therefore, it is important that you make your elections during your enrollment period carefully because you can only make changes during the year if you have a qualifying mid-year life event according to IRS regulations listed below.

Changes to your Medical, Dental, Vision or Flexible Spending Account can be made if preceded by a documented qualifying life event and if they are made within 30 days of the event. Your change must be consistent with your life event/status change. The following events qualify for a change in coverage:

- Marriage

- Divorce or legal separation

- Birth or placement for adoption of a child

(When adding a new baby to the plan, call MyEnroll as soon as possible with the Social Security Number to ensure the baby's coverage)

- Death of a dependent

- Ineligibility of a dependent

- Loss of other coverage

- Change in your employment status or that of your spouse

- Significant change in health coverage attributable to your employment or that of your spouse

- A court order

- Entitlement to Medicare or Medicaid

To make a change to your medical, dental or vision benefits or flexible spending account, you must experience a qualifying life event in accordance with IRS regulations.

If you experience one of these events and want to change your benefits, you must make the change within 30 days after the event occurs. Changes cannot be made before the event occurs. If you miss the window for making a change, there are no exceptions and you must wait to make an election during the next annual open enrollment period.

What are the Proof Documents needed for a Mid Year Life Event?

Mid-Year Life Event to remove a dependent:

Documentation (letter from new employer or new insurance carrier) showing coverage gained elsewhere including the date the coverage went into effect.

Mid-Year Life Event to add a dependent:

Documentation (letter from previous employer or previous insurance carrier) showing coverage lost, including the date the coverage terminate and those affected.

What is Continuation of Coverage?

As a church plan, the Archdiocese of Cincinnati's Health Plan is not subject to federal COBRA coverage. The Plan is subject to Ohio's continuation coverage requirements. The Archdiocese of Cincinnati offers continuation coverage to employees and their covered dependents who lose coverage under the Plan as a result of their involuntary termination of employment. To be eligible, you must have been covered by the Plan at the time of your termination of employment and your termination must not have been on account of gross misconduct. Contact your Business Manager or the Benefits Office at the Pastoral Center for the Archdiocese of Cincinnati for additional details.

Welfare Benefit Plan Summary

This document is a summary of the Archdiocese of Cincinnati Welfare Benefit Plan (the “Plan”). This Plan includes the following benefits: (i) major medical and prescription drug plan (“Health Plan”), dental plan (“Dental Plan”), vision plan (“Vision Plan”), a health care flexible spending account (“Health FSA”), a dependent care flexible spending account (“Dependent Care FSA”), group life insurance coverage (“Group Life”), supplemental life insurance coverage (“Supplemental Life”), accidental death and dismemberment insurance (“AD&D”), and long-term disability benefits (“LTD”). Each of the welfare benefit plans described in this summary is intended to be a “church plan” as defined under §414(e) of the Internal Revenue Code and §3(33) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”) which has not made an election under §410(d) of the Internal Revenue Code to become subject to ERISA, and as such, is exempt from the requirements of ERISA.

Follow this link to review and/or download a copy of the Welfare Benefit Plan Summary.

Publicly Available Cost Information/Transparency in Coverage

The link below leads to the machine readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine-readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.

about

The intent of these Employee Benefits webpages is to provide general information regarding the status of, and/or potential concerns related to, the current employee benefits environment. It does not necessarily fully address all specific issues. It should not be construed as, nor is it intended to provide, legal advice.

These Employee Benefits webpages are an outline of the coverage and services provided by the carrier(s) or vendor(s). They do not include all of the terms, coverage, exclusions, limitations, and conditions of the actual contract language. The policies and contracts themselves must be read for those details and are available for your reference through Archdiocese of Cincinnati or upon request.

The Archdiocese of Cincinnati Healthcare Plan fully complies with the ethical and religious directives of the United States Conference of Catholic Bishops.

The Archdiocese of Cincinnati reserves the right, in its sole discretion, to amend, modify, or terminate the Plan at any time and for any reason.

Notice of Privacy Practices

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) requires the Archdiocese of Cincinnati Healthcare Plan, including each of its component health plans, (collectively the “Plan”) to provide you with this Notice that explains our privacy practices and outlines your rights under the Plan.

Click on this link to read, download or print the Privacy Practices Notice.

notice of non discrimination

The Archdiocese of Cincinnati Healthcare Plan (the “Plan”) complies with applicable Federal civil rights laws and does not discriminate on the basis of race, color, national origin, age, disability, or sex. The Plan does not exclude people or treat them differently because of race, color, national origin, age, disability, or sex.

The Plan provides free aids and services to people with disabilities to communicate effectively with us, such as qualified sign language interpreters and written information in other formats (large print, audio, accessible electronic formats, other formats). Archdiocese provides free language services to people whose primary language is not English, such as qualified interpreters and information written in other languages. If you need these services, contact the Director of Human Resources of the Archdiocese at 513-263-6611

If you believe that the Plan has failed to provide these services or discriminated in another way on the basis of race, color, national origin, age, disability, or sex, you can file a grievance with: Rob Reid, Archdiocese of Cincinnati, Director of Human Resources, 100 E. Eighth Street, Cincinnati, OH 45202, Phone: 513-263-6611, Fax: 513-421-6225, Email: [email protected]. You can file a grievance in person or by mail, fax, or email.

You can also file a civil rights complaint with the U.S. Department of Health and Human Services, Office for Civil Rights, electronically through the Office for Civil Rights Complaint Portal, available at https://ocrportal.hhs.gov/ocr/portal/lobby.jsf, or by mail or phone at:

U.S. Department of Health and Human Services

200 Independence Avenue, SW

Room 509F, HHH Building

Washington, D.C. 20201

1-800-368-1019, 800-537-7697 (TDD)

Complaint forms are available at http://www.hhs.gov/ocr/office/file/index.html.

ATENCIÓN: si habla español, tiene a su disposición servicios gratuitos de asistencia lingüística. Llame al 513-421-3131.

注意:如果您使用繁體中文,您可以免費獲得語言援助服務。請致電 513-421-3131.

ACHTUNG: Wenn Sie Deutsch sprechen, stehen Ihnen kostenlos sprachliche Hilfsdienstleistungen zur Verfügung. Rufnummer: 513-421-3131

ملحوظة: إذا كنت تتحدث اذكر اللغة، فإن خدمات المساعدة اللغوية تتوافر لك بالمجان. اتصل برقم 513-421-3131

Wann du [Deitsch (Pennsylvania German / Dutch)] schwetzscht, kannscht du mitaus Koschte ebber gricke, ass dihr helft mit die englisch Schprooch. Ruf selli Nummer uff: Call 513-421-3131

ВНИМАНИЕ: Если вы говорите на русском языке, то вам доступны бесплатные услуги перевода. Звоните 513-421-3131.

ATTENTION : Si vous parlez français, des services d’aide linguistique vous sont proposés gratuitement. Appelez le 513-421-3131.

CHÚ Ý: Nếu bạn nói Tiếng Việt, có các dịch vụ hỗ trợ ngôn ngữ miễn phí dành cho bạn. Gọi số

XIYYEEFFANNAA: Afaan dubbattu Oroomiffa, tajaajila gargaarsa afaanii, kanfaltiidhaan ala, ni argama. Bilbilaa 513-421-3131.

XIYYEEFFANNAA: Afaan dubbattu Oroomiffa, tajaajila gargaarsa afaanii, kanfaltiidhaan ala, ni argama. Bilbilaa 513-421-3131.

주의: 한국어를 사용하시는 경우, 언어 지원 서비스를 무료로 이용하실 수 있습니다. 513-421-3131

ATTENZIONE: In caso la lingua parlata sia l’italiano, sono disponibili servizi di assistenza linguistica gratuiti. Chiamare il numero 513-421-3131.

注意事項:日本語を話される場合、無料の言語支援をご利用いただけます。513-421-3131

AANDACHT: Als u nederlands spreekt, kunt u gratis gebruikmaken van de taalkundige diensten. Bel 513-421-3131.

УВАГА! Якщо ви розмовляєте українською мовою, ви можете звернутися до безкоштовної служби мовної підтримки. Телефонуйте за номером 513-421-3131.

ATENȚIE: Dacă vorbiți limba română, vă stau la dispoziție servicii de asistență lingvistică, gratuit. Sunați la 513-421-3131.

|